Market Commentary & Outlook Fourth Quarter 2025

2025 In Review

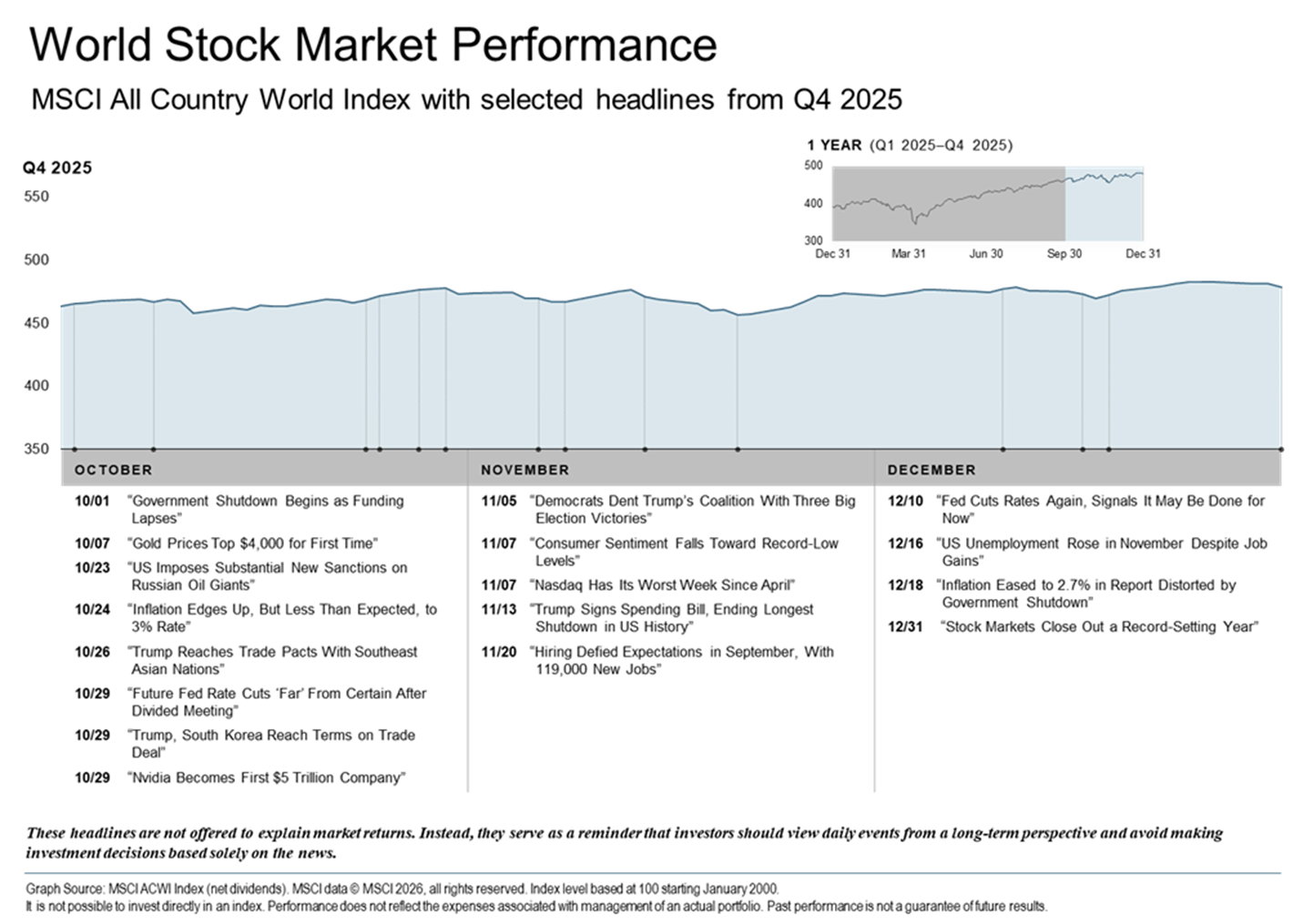

As 2025 draws to a close, financial markets have delivered a year of both resilience and recalibration. Despite plenty of uncertainty, the general trend was constructive. After two years marked by volatility, elevated inflation, and shifting Federal Reserve policy, investors this year saw signs of normalization—though not without lingering complexity.

The U.S. economy managed another year of modest growth, supported by a steady labor market, resilient consumer demand, and corporate earnings that proved stronger than many anticipated. Real GDP growth for 2025 is expected to have landed around 2.1%, a slight deceleration from 2024 but well above the feared “hard landing” many economists predicted a year ago.

Inflation continued its gradual return toward the Federal Reserve’s target, ending the year near 2.4%, compared to over 3% at the start of 2025. The Fed’s carefully communicated path of one rate cut in the second half of the year provided a signal of transition—from tightening to normalization—helping to stabilize both equity and fixed-income markets.

U.S. equities posted solid mid-single-digit gains in 2025, marking the third consecutive positive year for the S&P 500. Mega-cap technology firms continued to lead the way early in the year, boosted by advances in artificial intelligence and cloud infrastructure spending, but market breadth improved in the second half of 2025.

International markets delivered mixed results as Europe contended with muted growth and central bank caution, while emerging markets benefited from a rebound in commodity demand and relative stability in China’s fiscal policies.

Q4

Equity markets closed out 2025 with solid momentum, supported by easing inflation, improving monetary conditions, and resilient corporate earnings. Despite pockets of volatility tied to policy uncertainty and a cooling labor market, investors benefited from a constructive backdrop that helped lift both U.S. and international equities into year‑end.

Global Economy

International equities outpaced U.S. markets during the quarter, supported by a weaker U.S. dollar and improving economic conditions abroad. Developed markets posted steady gains, while emerging markets benefited from renewed demand tied to global AI supply chains—particularly in Korea and Taiwan. After a year marked by tariff‑related volatility, global markets broadly recovered into the year‑end.

U.S. Economy

The U.S. economy continued to expand, supported by strong consumer spending and a healthy, yet cooling labor market. The Federal Reserve cut rates twice during the quarter. Although some policymakers expressed concerns that the cutting went too far, concerns surrounding the gradually cooling labor market and easing price pressures influenced the decision to focus on supporting economic stability.

Equity Markets

U.S. stocks delivered positive returns in the fourth quarter, with the S&P 500 rising as investors responded to stabilizing inflation and continued strength in corporate profitability. Value sectors outperformed growth as investors became more selective, particularly around artificial intelligence investments. Sector leadership reinforced the importance of diversification. Health care stood out as the top performer while real estate and utilities lagged.

- Health Care Sector top performer, gaining 11.2%

Communication Services saw a 7.05% increase and 32.41% YTD

Fixed Income

Bond markets strengthened as the Fed continued its shift toward accommodation. Intermediate‑term yields declined, supporting total returns across high‑quality fixed income. While spreads remained tight, high‑quality credit continued to offer stability and income in a moderating inflation environment.

- 2-year Treasury yield fell to approximately 3.47%

- 10-year Treasury yield ended Q4 at 4.17%

Commodities

Real assets delivered mixed results for the quarter. Precious metals continued to perform well with silver surging 50% and gold climbing 12% during Q4.

Looking Ahead to 2026

As we enter 2026, several dynamics will shape the investment landscape:

- The Federal Reserve’s Policy Path: Markets currently anticipate one to two modest rate cuts in 2026, contingent on continued disinflation and stable employment trends.

- Corporate Earnings: Expected growth of around 8% in S&P 500 earnings will rely heavily on consumer resilience and continued investment in technology and automation.

Geopolitical Considerations: Trade relations, global elections, and energy market dynamics remain potential sources of volatility amid a maturing global economic cycle.

While the coming year may bring increased market consolidation following the growth recovery of 2025, we believe diversified portfolios remain well positioned to capture long-term opportunities. Quality, discipline, and thoughtful asset allocation will again be key themes for the new year.

Our Perspective

At Paradigm Wealth Management, our focus remains on helping clients navigate changing markets with clarity and confidence. We continue to emphasize diversified strategies tailored to individual goals—with an eye on managing risk, maintaining liquidity, and positioning portfolios for both growth and stability.

We are grateful for your continued trust and partnership throughout 2025 and look forward to serving you in what promises to be another eventful and opportunity-filled year ahead.

References: Fidelity Investments, Morningstar, Bloomberg, Forbes, Dimensional