Market Commentary and Outlook Third Quarter 2025

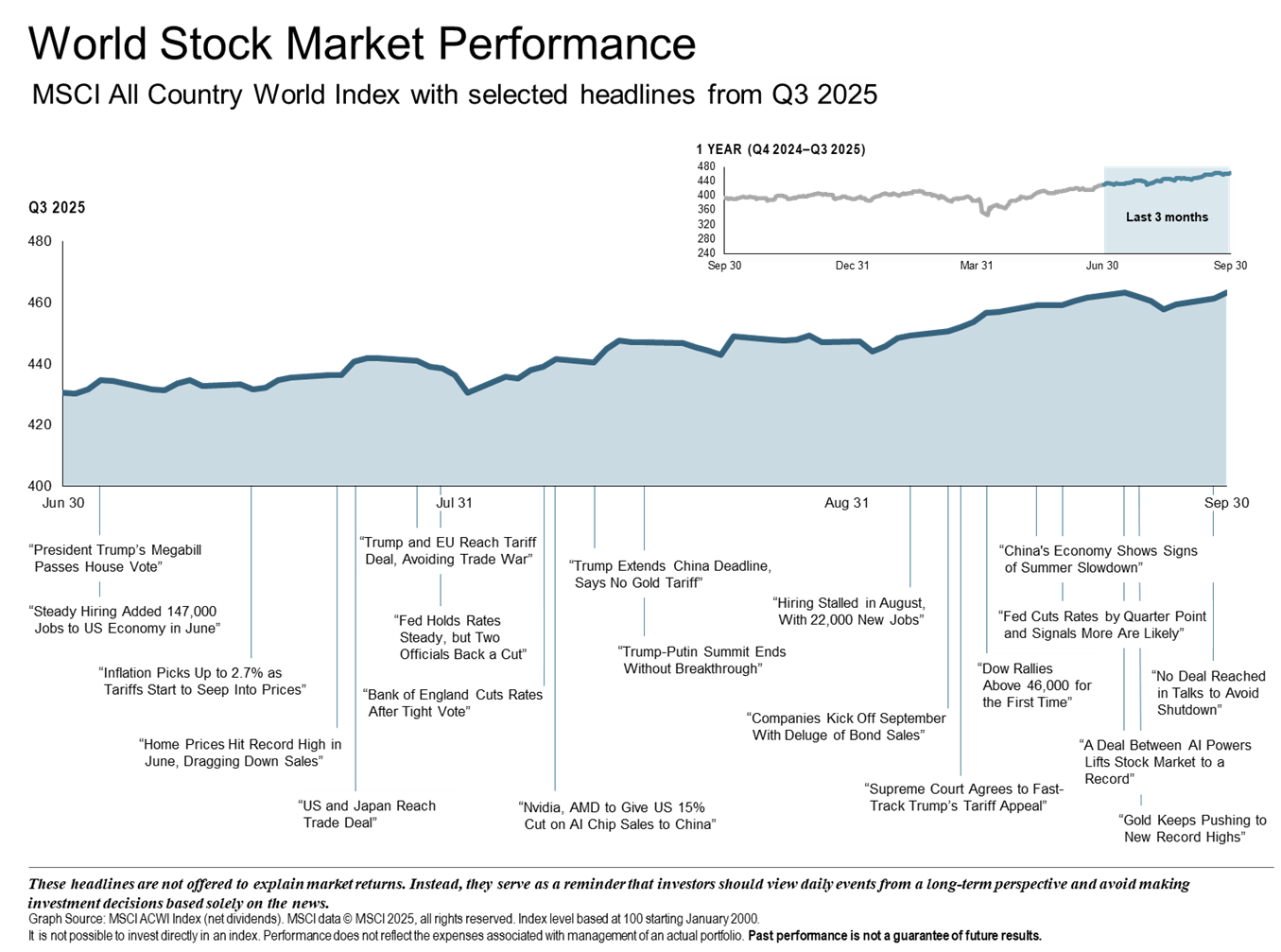

Many themes common for 2025 persisted in Q3. Global financial markets continued to perform strongly with equity markets avoiding the “September Effect” at the end of the quarter. Historically the worst month of the year for the stock market, from 1928 - 2023 the S&P 500 has averaged a decline during the month of September. Although it underperformed non-U.S. equities, the S&P 500 gained approximately 3.6% this September, its strongest September performance in 15 years.

Artificial Intelligence and technology demand as well as strong corporate earnings were significant drivers contributing to global market gains while the weaker U.S. dollar helped emerging markets. Risks have also remained the same with concerns regarding elevated stock valuations, persistent inflation, and ongoing geopolitical tensions noted as potential threats.

Global Economy

Both developing and emerging markets performed well in Q3. The Eurozone experienced positive gains led by the financials and communication services sectors. The European Central Bank President, Christine Lagarde confirmed that the inflation spike that occurred between 2022 and 2024 has subsided while also stating that the Eurozone has managed better than expected in regard to the U.S. initiated trade tariffs.

U.K equities performed well with communication services and technology, propelled by AI enthusiasm, seeing the highest returns. In response to persistent inflation, the Bank of England’s Monetary Policy Committee initiated its first cut since 2020.

Japan continued to experience record highs with the TOPIX Total Return gaining 11.4% and the Nikkei 225 returning 11%.

AI momentum helped Emerging Markets see double digit returns, outperforming many developed markets. AI-related companies in China, Taiwan, and South Korea posted particularly strong gains.

U.S. Economy

The U.S. economy has continued to prove resilience with stronger than expected GDP growth (3.8%) and solid consumer spending in Q2. According to the Bureau of Economic Analysis, consumer spending, particularly on services, was stronger than estimated. The first-quarter GDP drop appears to be mainly caused by a surge in imports (which are subtracted from GDP) as businesses hurried to bring in foreign goods before tariff increases. Economists have indicated that these results should ease fears that the U.S. is on the cusp of a slowdown.

Equity Markets

Equity markets continued their momentum with the S&P500 and Nasdaq Composite setting record highs. Technology and Communication Services were strong performers (fueled by continued enthusiasm for AI) while healthcare and energy lagged. Although mega-cap technology stocks led the advancement, Q3 saw a broadening of gains. The Federal Reserve cut its rate by 25 basis points in September with chairman Jerome Powell characterizing the decision as “risk management” to address labor market concerns.

- S&P 500 returned 8.1% while Nasdaq Composite gained 11.24%

- Technology stocks dominated, returning over 22%

- Healthcare returned -7.4%, Energy returned -8.4%

- Small-cap stocks rallied with the Russell 2000 returning approximately 12%

Fixed Income

Fixed income performed well in Q3 supported by the Federal Reserve’s September rate cut. Investment-grade municipal bonds outperformed most fixed income indices. Short-term yields fell more sharply than long-term yields, resulting in a steepening yield curve.

Commodities

Global macroeconomic development played a major role in commodity performance during Q2. Oil prices hit a 4-year low in April with only a brief rebound during the Iran- Isreal conflict. Traditional safe-haven assets such as gold and silver continued their run, outperforming broad commodities as well as the US dollar.

Looking Forward

The final quarter of the year looks like it will be constructive, but not without risk. The Federal Reserve’s response to the softer labor market in September eased investor concerns, but their next move will be closely monitored as additional rate cuts are expected before year end. Q4 will be data-dependent with jobs, inflation, and consumer spending data affecting the market and economic outlook.

Policy uncertainty and AI have been themes thus far in 2025 and will likely continue. Q3 earnings will carry significant weight as companies update investors on the impact of tariffs and their 2026 outlook. AI-related capital expenditures will continue as companies look to boost productivity and offset a slowdown in the labor force. Skepticism around whether AI spending is outpacing potential revenue growth could affect the technology sector's leadership, impacting the broader equity market.

Market themes come and go. Geopolitical tension, the pandemic, and technological innovation are just a handful of events that have had significant impact on economic conditions in recent years. No one is able to predict what may impact the markets next, but we can be certain that our mission at Paradigm Wealth Management will remain unchanged. We pride ourselves in our unwavering disciplined approach that places focus on each client’s individual needs and goals.

Thank you for your continued trust in our service. We look forward to connecting with you soon.

References: Fidelity Investments, Morningstar, Bloomberg, Forbes, Dimensional