Market Commentary & Outlook Second Quarter 2025

Q2

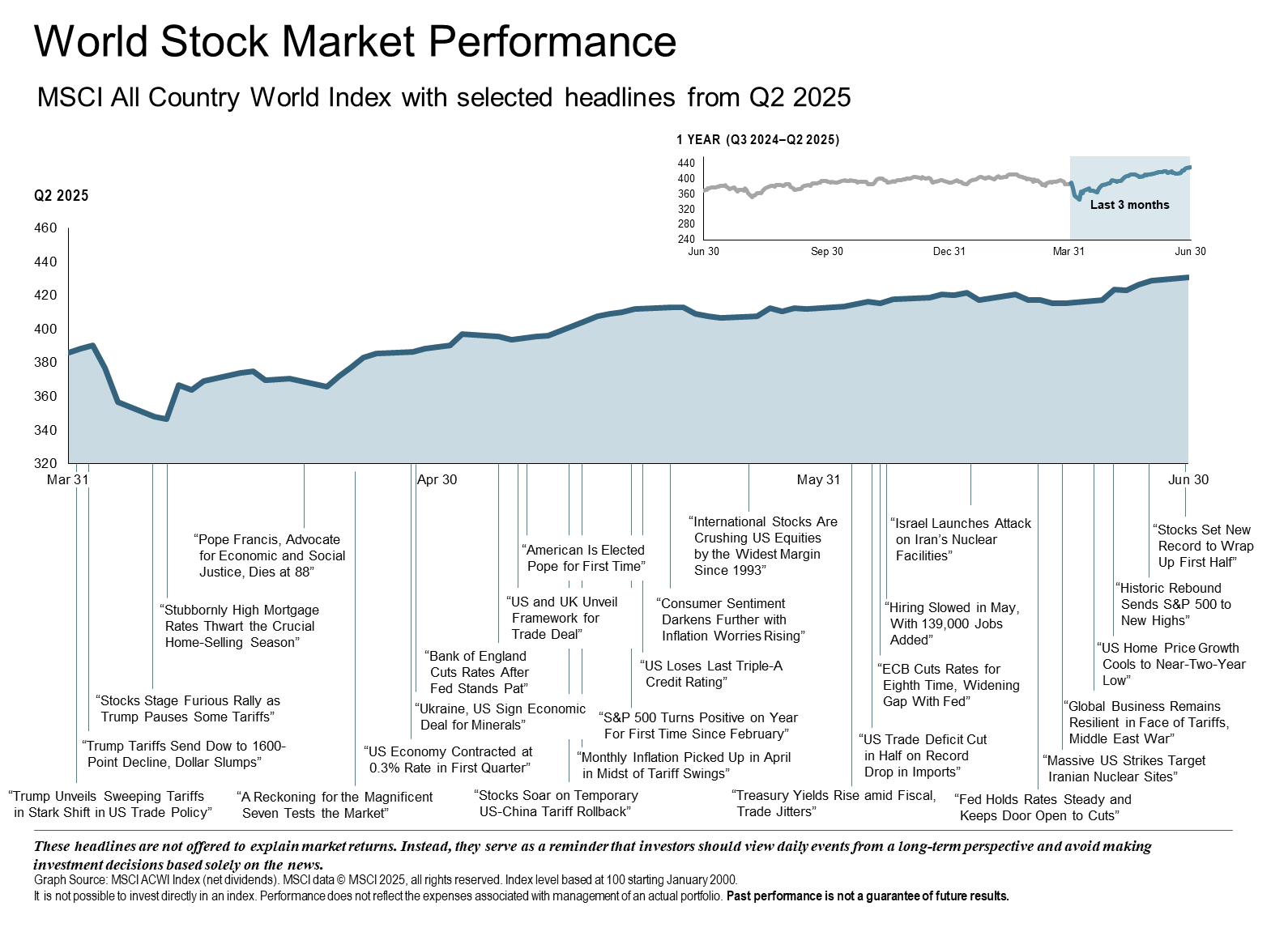

Markets opened Q2 with a jolt as President Trump’s Liberation Day tariff announcement prompted a massive sell-off. However, sentiment changed a week later when reciprocal tariffs were paused for all trading partners except China. The S&P 500 rebounded with a 9.5% gain, the largest single-day gain since we were entrenched in the Global Financial Crisis. June brought about more geopolitical concerns as Isreal launched airstrikes on Iranian nuclear facilities. Oil prices responded quickly, but a ceasefire announcement two weeks later pared back gains as fears of a wider regional conflict eased.

Despite noisy headlines and big policy swings, investor sentiment improved as a solid job report for April surfaced and corporate earnings came in better than expected. Q2 finished on a positive note with the S&P 500, the Nasdaq, and the Dow Jones all reporting significant gains.

Global Economy

Foreign equities had another positive quarter with the MSCI ACWI ex-USA Index posting a 12% gain. The European Central Bank implemented two 25-basis-point rate cuts. With U.S. exports only making up 3% of the EU’s economy, ongoing tariff threats have had little impact on the overall economy while the weak U.S. dollar has been an asset.

The UK also outperformed U.S. equities in the 2nd quarter with a shift away from U.S. technology stocks.

Relatively insulated from global tariff risks, Japan’s Nikkei 225 saw a 14.8% gain.

Emerging markets also posted positive gains, largely benefiting from the combination of weaker dollar conditions, de-escalating trade tensions, and improving policy flexibility.

U.S. Economy

According to Bloomberg consensus, the U.S. economy is expected to see the strongest quarterly growth of the year. The GDP is estimated at ~2.5% annualized growth after a Q1 contraction. Job growth cooled to ~1% year-over-year, though the labor market remains resilient. Core inflation trends remain favorable, prompting the Fed to hold rates steady. Opinions on rate cuts later this year vary, with some predicting a rate cut late in the year while others disagree.

Equity Markets

Despite immense volatility, the U.S. stock market remained remarkably resilient. After a lackluster Q1, the Magnificent 7 rebounded. U.S. large cap stocks surged in Q2, with the S&P 500 up 10.9% and the Nasdaq rallying 18%. Earnings in tech and communication services, especially AI-related, performed especially well. Small caps also gained an impressive 8.5%.

• U.S. Growth gained 17.6%

• U.S. Large Cap gained 10.6%

• Information Technology and Communication Services were top performers

Fixed Income

Early April tariff announcements induced a sharp plunge in yields, with the 10-year Treasury falling nearly 40 basis points in less than a week. In similar fashion to other assets, yields quickly rebounded, resuming the familiar oscillating pattern seen over the past year as investor sentiment toward the economy, and the Fed’s potential response, fluctuated.

Credit-sensitive sectors such as high-yield corporate bonds and emerging market debt led fixed income markets, returning 3.6% and 3.3% respectively.

Commodities

Global macroeconomic development played a major role in commodity performance during Q2. Oil prices hit a 4-year low in April with only a brief rebound during the Iran- Isreal conflict. Traditional safe-haven assets such as gold and silver continued their run, outperforming broad commodities as well as the US dollar.

Looking Forward

Geopolitical conflict, sticky inflation, and ongoing tariff concerns remain risks moving forward. Shifting long-term trends including unprecedented debt level, widespread aging demographics, peak globalization, and geopolitical instability are all reasons to strategically diversify across caps, sectors, and geographies. Our emphasis remains on a disciplined, process-driven portfolio with targeted tilts in innovation-led and yield-supporting assets.

At Paradigm, our mission remains unchanged: thoughtful diversification, disciplined positioning, and client-focused stewardship. We believe this portfolio is positioned to weather volatility, capitalize on ongoing AI-driven structural growth, and adapt to evolving economic conditions.

As always, we welcome your questions and insights.

References: Fidelity Investments, Morningstar, Bloomberg, Forbes, Dimensional